Right at this very second, the largest transfer of wealth in the history of humanity is underway. It has been going on since 2009, but it’s really picked up speed in the last 6 months. A couple of days ago, I wrote a detailed post on RVF explaining Bitcoin in layman’s terms. I strongly suggest that every reader of this post spend 10 minutes on that explanation, but if you’re too lazy then here’s the summary:

- Bitcoin is the world’s largest cryptocurrency, essentially money for the Internet. It is an open source Internet protocol, like HTTP. It was hypothesized and first developed by an anonymous author or group under the name “Satoshi Nakamoto”.

- Bitcoin is pioneering the idea of a deflationary currency, something which has never been possible before in humanity’s history. Gold and silver come close, but not all of it has been dug out of the ground yet. The only two possibilities for Bitcoin are that its value goes to zero, or increases. There is no possibility that the value ever decreases or stabilizes (in the medium term). In the long term, Bitcoin’s value will increase at a decreasing rate, but never stop, as it can be lost but not replaced.

- Unlike gold and silver, Bitcoin can be essentially perfectly subdivided, and transmitted anywhere on the planet for almost nothing between any two parties with an Internet connection.

- Bitcoin is decentralized like the Tor network, so it cannot be regulated or controlled by any government or authority body.

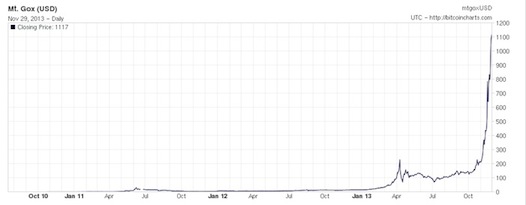

One Bitcoin has climbed from less than $200 to peaks over $1000 in the last month. Every currency and medium of exchange on the planet is down against the Bitcoin over the last year, including gold and oil.

Innovation Means Winners And Losers

There is a hard limit of just under 21 million Bitcoins. That means less than 1 in 300 people could own a full one, even if evenly distributed, which they are not (there’s already a number of investors that own hundreds or thousands or more).

One Bitcoin can be subdivided down into 100 million Satoshis (the smallest unit). Even if the world’s money supply was entirely Bitcoin, one Satoshi would be worth just a couple of cents in today’s USD, allowing for small transactions. If this were to happen, many many people would be reduced to poverty, living their entire lives on a few Millibits (thousandths of a Bitcoin) or Satoshis.

The new 1% is anyone that currently owns at least one Bitcoin, the world just doesn’t know it yet. Like this, but on a world scale. For the most part, this includes white, technically-minded, middle-aged American men but increasingly comprises Chinese technophiles and a cross section of society in economically unstable countries like Cyprus and Argentina.

The US government is starting to clue in and realises it needs to know what’s going on, but all they need to understand is that they can benefit from supporting it, or be trampled as they attempt to regulate something beyond their control.

I can’t say it any better than one of the commentators on the linked article (although I disagree about the inevitability of war and death), so here’s “Dumbhandle”:

US Government: Pay attention. You have almost destroyed the future of our country by retarding bitcoin usage in the US with the ham fisted application and mismanagement of various regs. Wealth is fleeing already to China and accelerating. You have a very short time to deregulate in order to attract bitcoin wealth to the US before the bitcoin black hole inevitably sucks in all world fiat currencies and the flow of XBT wealth to China and other counties accelerates.

Against all odds, your Chinese colleagues have realized this and are working as a team to effectuate capital accumulation over there. They are winning, because they understand fiats and the petro are finished. You need to immediately pull in some experts from the bitcoin community to explain this to you so you can take proper emergency evasive action to reverse the flow back to the US. Here is your goal: deregulate to reverse the capital flight. Then watch the global conversion of fiat to bitcoin. Watch bitcoin accumulate in the most innovative place in the world, the US. Sit back and watch a golden age bloom here and it spreads globally. Any other course will result in wars and death on a massive scale. Now we will watch you screw it up.

Bitcoin Doesn’t Care

Just like hypergamy and evolution, Bitcoin doesn’t care.

- It doesn’t care if you didn’t know

- It doesn’t care if you don’t understand

- It doesn’t care if you don’t believe

The critics will cry that “Bitcoin is just a bubble” (alternatively: pyramid scheme), and they’d be right. It’s a bubble in exactly the same way as the US dollar, which also gets its value entirely from community consensus (the paper it’s printed with cannot be eaten, used as construction material and is pretty poor fire fuel). I am more prepared to trust a democratic, distributed, deflationary technology than the self-serving government printing press, and I suspect a lot of others might too. I’m not alarmed by Bitcoin’s incredible growth, it’s just following the same S curve that tech giants like Facebook and Twitter tend to.

Absent any flaw being found in the source code (which has been publicly available and reviewed for years), or more likely one being introduced by the core development team (still a vanishingly unlikely proposition), I believe 1 Bitcoin will be worth at least US$ 100 000 by 31st December 2016. The Winklevoss twins think even higher. Max Keiser thinks even higher. Even Peter Thiel (Paypal co-founder) agrees the revolution has begun. Although ultimately, we’re all pure speculators on a very untested new technology.

The only other potential issue is advances in quantum computing that smashes apart current encryption standards, but that would cause far larger problems with all online privacy. If anyone would come out on top it’s the forward-thinking and technically-minded Bitcoin community.

Adapt or live with regret among the masses. You have been warned. At the very least, do some reading and make an informed decision.

Bitcoin daily closing prices on MtGox for the last 4 years (to Nov 29), from sub-5 dollars to over $1000. The closing of illegal, anonymous online marketplace Silk Road knocked the price off for a while, but it freed Bitcoin from any accusations of being useful only for drug deals. The road up is going to be rocky, but there is no stopping the train now.

NB: In the time taken for this post to go through the ROK submission and editing process, closing prices have doubled. The original version of this article had the graph below finishing at $450.

Read More: There Is No Hedge Against Inflation

Leave a Reply