Like most advice given to us by our schools, churches, governments, and even well-meaning parents the financial advice we have been given has led us wrong. We’ve been told outdated maxims and advice that just won’t cut in today’s world and may even work against us. Just like at one time getting married may have been good advice, things have changed dramatically over the past sixty years.

For starters let’s get something straight. Corporations are not pro-masculine. Many people like to believe that somehow the business world has not been affected by the past sixty years of indoctrination but nothing could be further from the truth. While those familiar with the manosphere are well aware of this, others who are not as “enlightened” still cling to this fantasy. This isn’t the 80’s. The alpha take charge attitude is more likely to get you fired than promoted in today’s corporate culture. Despite being better for profits and productivity.

That’s another thing. For most businesses today profits and productivity take a distant second and third to political correctness. Over the long run these companies will be destroyed by others who actually do the things that work. However until then this is the corporate culture that men will find themselves in. And it’s not pretty.

Because of this many men want to strike out on their own. whether that means living a minimalist lifestyle working odd jobs here and there or creating their own entrepreneurial ventures. Whatever the case, falling for these three lies will hamper you from accomplishing your goals. So let’s get started.

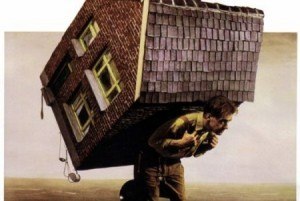

Lie #1 – Your House is an Asset

Put simply an asset is something that makes you money. Something that adds to your bank, not takes away. Does this sound like your house? Now I’m not talking about owning real estate—that’s different. What I am talking about is using your hard earned money paying for the suburb house with the white picket fence.

A house is like an ungrateful kid. You constantly feed and nurture it and it gives you crap in return. Between volatile markets, being tied down, and the interest payments on your mortgage buying a house can ruin your life at worst and at best maybe you can sell it for a little more after so many years. A huge downside and a little upside. Not a good deal.

There may have been a time when buying a house was a good idea. When you could find stable work that paid you well. When you could find a stable woman and raise a stable family with her. None of that happens anymore. America is anything but stable. This isn’t the 1950’s and believing in what worked then will get you screwed now.

I would suggest you rent. Now before there was a negative association with someone who rented. However this stigma has largely faded as more and more people are forced to rent. Look at it like this. Renting is like sleeping with a beautiful woman while another guy deals with all her crap, whereas buying a house is like getting married and having to deal with all the woman’s crap because she is now your woman. The largest benefit of renting is the freedom it gives you.

Lie #2 – Corporations Reward Hard Work

This was addressed a little in the introduction but we’ll go into more depth here. First off corporations, especially large ones, do not have profit or productivity on their mind. They have maintaining the status quo, placating SJWs, and staying “relevant” as their main goals. Again this will ultimately be their downfall, but until then those of us working in the corporate environment are forced to deal with it.

Most likely if you work in modern corporate America your boss is sadistic. This isn’t name calling but a fact. And no that’s not an exaggeration as the dictionary defines sadism as “the condition in which sexual gratification depends on causing pain or degradation to others” or even better “any enjoyment in being cruel.” Sound familiar?

Again, at one time being loyal meant something. Loyalty was something to be rewarded and admired. Now being loyal is a liability. Be loyal to a company and watch as anyone in a protected class is promoted over you and expunged from any wrongdoing. Yet at the same time bosses still need a scapegoat so guess who that will be? (Hint it’s you).

Like Aaron Clarey suggests, use corporations and don’t be used by them. This means you should use a job to get an income that will help you further you own goals. Don’t expect your loyalty to be rewarded and don’t ever feel bad for leaving a company. They will use you as a workhorse and then spit you out when you no longer are useful to them. They will use and abuse you as much as any sadistic woman would. Use the income to build something of your own, then drop them as soon as you can.

Lie #3 – All Debt Is Bad

Alright, first a disclaimer. Most debt is bad. Debt for a house, car, “education,” or any other trinket is bad. However, not all debt is bad. There is such a thing as good debt. And it all depends on what that debt is for.

We’ve all been told to avoid debt at the expense of just about anything else. Doesn’t mean people listened but nevertheless everyone knows that debt is bad. And when everyone knows something it’s pretty much a guarantee that what everyone “knows” is wrong.

There are two parts as to why debt is not your problem.

First off, debt used to fund a business, deal, or in other words when used as an asset, can be good. Not all of us have enough money for a startup and borrowing can speed up growth. You’re much better off borrowing some money to start an intelligent business than you are sitting back and waiting a couple years to save up the income. Remember time is your most valuable asset, not money. So in this case debt works for you and not against you.

Now while I am an advocate of minimalism I am an advocate of minimalism with one caveat. And that caveat is: you should live below your means while working on expanding your means. Meaning you should live below your income level while at the same time seeking to expand your income level.

Most people’s problem is not that they have debt but that they don’t have enough income. Pinching pennies will never make you rich or even comfortable. Obviously some people are reckless with their debt and need to get their spending under control to start. But for others debt can be leveraged to become an asset in the long term.

Wrap-up

This is really just the very tip of the iceberg we’re discussing here. The lies run long and deep about finances just like they do in regards to what turns women on and what it means to be a man. There is a red pill and blue fill for finances as well. And just like taking the blue pill in other aspects of your life, taking the blue pill in finances can lead to your life being ruined.

The truth will set you free but first you must be exposed to it.

If you like this article and are concerned about the future of the Western world, check out Roosh's book Free Speech Isn't Free. It gives an inside look to how the globalist establishment is attempting to marginalize masculine men with a leftist agenda that promotes censorship, feminism, and sterility. It also shares key knowledge and tools that you can use to defend yourself against social justice attacks. Click here to learn more about the book. Your support will help maintain our operation.

If you like this article and are concerned about the future of the Western world, check out Roosh's book Free Speech Isn't Free. It gives an inside look to how the globalist establishment is attempting to marginalize masculine men with a leftist agenda that promotes censorship, feminism, and sterility. It also shares key knowledge and tools that you can use to defend yourself against social justice attacks. Click here to learn more about the book. Your support will help maintain our operation.

Leave a Reply