A couple of weeks ago, a student at my high school stated a rather interesting thing that stuck with me for days. We were in economics class discussing “how worthy a college degree is,” with our teacher saying it is very useful and a great way to make money, especially due to its high return on investment.

To make things even more interesting, a student stated that just a few days ago he read that if you invest now in your college degree, that in timeframe of 10 years, you would have a ROI of one million dollars. I kept silent throughout the whole class.

The cost of a bachelor’s degree

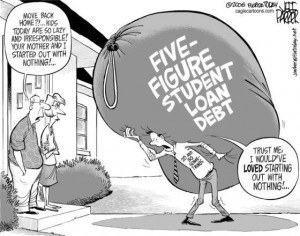

The average cost of Bachelor’s Degree is $31,374. I added up all three values, those of in and out-of-state colleges, as well as private colleges, and divided them by three. This excludes costs of living (socializing, eating out, buying commodities and so on). So, after four years, your total debt is $125,500. You then go on to look for a job to pay off that debt.

Average bachelor’s degree salary

Next up, let’s consider the income you will be having after attaining that shiny bachelor’s degree. But first, we must take into account that already four years have passed out of the 10 years my classmate was talking about, so we have six years more to net that $1,000,000.

In that spirit, I went online and searched for an average salary with a bachelor’s degree and found out that the average starter salary is $39,000, but let’s assume you have climbed the corporate ladder and take an average salary of $45,000. So, $45,000 x 6 = $270,000. You must be saying, not bad! Just kidding.

Paying off that debt

Well, we have earned $270,000 in those 6 years, but we must also deduct all that student debt we have. Where does that leave us? Well, if we deduct $125,500 from $270,000$, we get $144,500. After paying off all the student debt with zero interest rate (good luck with that), you are left with $144,500 for six years of a hard nine-to-five job you probably hate. Annually, that is a mere $24,000 bump, which is $2,000 monthly. Hmm, but where does the cost of living come into all of this?

More costs please

Since we live on planet Earth, there are a few costs associated with living as a college-educated corporate goon. Things such as rent, utilities, car payments, credit card debts, food, clothes, and luxuries such as iPhones must be taken into account as well.

If you were to live with a minimalistic lifestyle in the US in a second-tier city, $2,000 monthly only for yourself would be sufficient. Well, that would leave you with zero ROI at the end of those ten years. In fact, you still need $1 million more to have $1 million.

And suddenly, the reality strikes

According to good old Wikipedia, the average household debt has been over 110% in 2011. We can imagine that four years later, there will have been an increase. But, we must also remember that we are taking about you and your ROI as an individual. So, similar numbers can be applied, but let’s say that it is around 130%, which sums up to be around $2,600 of spending a month.

So, what just happened? You are actually spending more than you earn? With your debt being 130%, that means you have spent $187,850 in those six years, but have only earned $144,500. This doesn’t even take into account the opportunity cost of the four years where you were’t making any money and could have been learning a valuable skill while getting paid for it.

Conclusion

So, what are the options? You can choose to listen to my classmate and pretty much 99% of people in your slavish environment and hope for a million bucks to fall from the sky after finishing four years at a soul draining, hyper-feminist institution, or you can choose to live a life of choice.

Think outside the box, do not get into college debt, and take The Road Not Taken. There’s plenty of options to choose from, but the main decision will be the one you take, and it will make all the difference.

Read More: 5 Reasons Why Girls With Tattoos And Piercings Are Broken

Leave a Reply